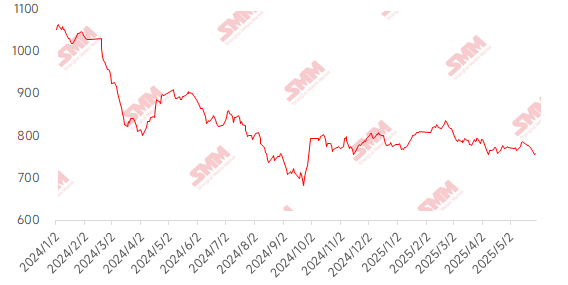

This week, imported iron ore prices exhibited a fluctuating trend within a narrow range, primarily influenced by a weakening macroeconomic outlook and pressure on fundamental factors. In the market, news of the China-US London negotiations led to a shift in tariff expectations from strong to weak, undermining support in the futures market. On the supply and demand front, global iron ore shipments increased slightly, with port arrivals rising by 2.21 million mt MoM, significantly intensifying supply pressure. On the demand side, the situation continued to weaken due to a decline in daily average pig iron production and the onset of the rainy season in south China. Apparent demand for rebar further contracted, prompting some steel mills to begin reducing pig iron output. The imbalance between strong supply and weak demand led to a slight inventory buildup at ports. Additionally, the rapid contraction of the spot-futures price spread for PB fines, driven by strong selling intentions among traders, further suppressed the upward momentum of futures. In terms of port spot prices, the weekly average price of PB fines at Shandong ports fell by 8 yuan/mt MoM.

Chart-: SMM 62% Import Ore MMi Index

Source: SMM

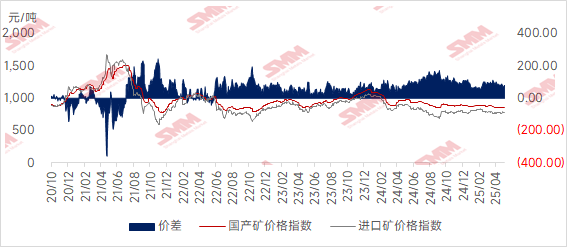

This week, domestic ore prices declined slightly, and it is expected that domestic ore prices will continue to edge down slightly next week. In Hebei's Tangshan, Qian'an, and Qianxi regions, prices fell by 1-5 yuan/mt, while in west Liaoning's Chaoyang, Beipiao, and Jianping regions, prices also dropped by 1-5 yuan/mt. In east China, prices decreased by 5-10 yuan/mt.

In the Tangshan region of Hebei, iron ore concentrate prices remained generally stable, with the 66% grade dry-basis tax-inclusive delivery-to-factory price still holding at 915-920 yuan/mt. Both supply and demand sides maintained a wait-and-see sentiment, with trading activity remaining sluggish. Overall operating rates at mines and beneficiation plants remained relatively low. Major mines still maintained profits of 100-200 yuan/mt, while concentrate plants were mostly operating at a loss. Overall resources remained relatively tight. On the demand side, local steel mills have recently begun formulating annual maintenance plans, weakening demand support. Moreover, their demand for domestic iron ore concentrates is primarily based on purchasing as needed, resulting in a situation of weak supply and demand in the market.

In the domestic ore market of west Liaoning, transactions were weak, and prices fluctuated slightly downward, with the 66% grade iron ore concentrate wet-basis ex-factory price (tax excluded) at 680-690 yuan/mt. Local raw ore resources were scarce, with most mine resources being supplied to their own beneficiation plants. Independent beneficiation plants in the region faced difficulties in externally purchasing raw ore, resulting in relatively high procurement costs. Coupled with the current weak market conditions, a small number of producers chose to halt production for maintenance due to low shipping profits. On the demand side, some local steel mills experienced losses, and their demand for iron ore was primarily based on purchasing as needed, resulting in generally weak market transactions.

In east China, the overall production at mines and beneficiation plants of iron ore concentrates remained relatively stable. Following previous sales promotions, shipping conditions improved, leading to a slight decrease in overall inventory. However, the overall cost-effectiveness of domestic iron ore concentrates remained relatively weak.

Chart-: Price Spread Between Domestic and Imported Ores

Source: SMM

Looking ahead to next week

For imported ore: The iron ore market is expected to maintain a pattern of in the doldrums, with bullish and bearish factors intertwined. On the supply side, overseas shipments remain at a seasonal high. However, due to the impact of typhoon weather in south China, port unloading efficiency may be constrained, and the increase in port arrivals is expected to narrow. On the demand side, the daily average pig iron production continues to decline slightly. Coupled with the persistent rainfall in south China, which suppresses end-user steel demand, steel mills' procurement remains focused on restocking based on demand. Currently, the structure of high pig iron production and low inventory still provides some support for ore prices. However, the characteristics of the industry's off-season are evident, and market sentiment is generally pessimistic. From a macro perspective, the uncertainty surrounding China-US tariff policies continues to disrupt market expectations, causing traders to operate more cautiously. Overall, against the backdrop of weak supply and demand, iron ore prices are expected to continue fluctuating rangebound and in the doldrums next week, with the fluctuation range possibly narrowing further. Close attention should be paid to the actual impact of typhoons on logistics and adjustments to production schedules in response to changes in steel mill profits.

From the perspective of domestic ore: Overall, the cost-effectiveness of domestic iron ore concentrates remains relatively weak. Although supply is currently tight, there has been no significant improvement in demand. Coupled with the recent impact of external steel tariff-related factors, overall market confidence is weak. It is expected that the price of domestic iron ore concentrates will continue to fluctuate rangebound and in the doldrums next week.

》Click to view the SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)